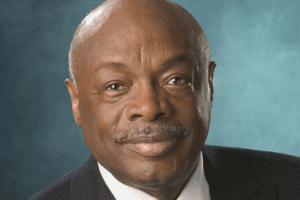

By Willie L. Brown Jr., Special to CalMatters, April 14, 2020

The same groups that fought the ballot measure more than four decades ago when 65 percent of the state’s electorate passed it have repeatedly tried to destroy the measure’s important property tax protections.

When Prop. 13 was on the ballot in 1978 I opposed it, but the voters approved it. As chair of the Assembly Revenue and Taxation Committee, I had a responsibility for the legislative implementation of Prop. 13 to make it work.

However, in the decades following Prop. 13’s implementation, I’ve come to recognize the law’s many benefits. For homeowners, small business owners and employers – large and small – Prop. 13 has provided stability, predictability and certainty. This certainty is even more important for the 46 percent of California businesses that are owned by racial minorities including African Americans.

California has a feast-or-famine budget. When economic times are good, large businesses and the well-off fund the vast majority of California’s budget. This funding allows the state to provide generous benefits to Californians who need them most. However, when the state faces an economic downtown, revenues coming into the Capitol crash – and with it, public education and social safety net programs are stretched thin.

This November, many of the same groups that opposed Prop. 13 four decades ago are pushing the largest property tax increase in California history – a shortsighted act made even more myopic given the walloping we’re experiencing with the COVID-19 crisis. Today, tens of thousands of small businesses across California have shuttered their stores. Still, proponents are proceeding full speed ahead with a proposal that will remove business properties from Prop. 13’s protections and require them to be reassessed at current market value at least every three years.

This unprecedented property tax increase will raise costs to businesses by up to $12.5 billion annually or, if they lease, lead to significant rent increases. Businesses, in turn, will pass these higher costs on to consumers – families and other small businesses – ultimately making everything we buy more expensive.

Proponents of this massive property tax hike attempt to portray their measure as “small business friendly” by claiming small businesses are exempt. This demonstrates a general lack of awareness of how most small businesses operate. Most small businesses rent the property where they operate and have what’s called a “triple net lease,” where property taxes, insurance and maintenance costs are passed directly onto tenants.

Worse still, as a former legislator and leader in California’s African American community, for African American small business owners, the measure’s skyrocketing property tax increases will be devastating. Many of the fore mentioned are my friends and clients.

Look at the facts: According to the 2012 Survey of Business Owners by the U.S. Census Bureau, 46 percent of all businesses in the state are owned by racial minorities including African Americans. They often rent their property and are subject to higher rents when property taxes increase. And, African American-owned small businesses are nearly twice as likely to fail because they have insufficient cash flow or sales to cover their costs than U.S. businesses as a whole.

Even before the unpredictable, tumultuous events of COVID-19, this massive property tax increase demonstrates an insensitivity and lack of awareness about the struggles that small businesses, particularly minority small businesses, face.

If small business owners manage to stay in business – which is no guarantee – adding to their challenges is neither prudent nor advised. Changing course on Prop. 13 will not only be costly to you and me, but it will be costly for California and our economy as a whole.

–Willie Brown is a former San Francisco mayor and the longest serving Speaker of the California Assembly, Wlb@williebrowninc.com.

Editor’s Note: We would like to thank Neil Chase, CEO of CalMatters, for granting us permission to reprint Willie Brown’s guest commentary, which originally ran in CalMatters on April 14, 2020. CalMatters is a nonpartisan, nonprofit journalism venture committed to explaining how California’s state Capitol works and why it matters. To learn more, please visit https://calmatters.org/

Please join the Silicon Valley Leadership Group and hundreds of state and regional organizations and elected officials in opposition to Prop 15, the special-interest-backed $11.5 billion-a-year property tax hike that undermines Prop 13. Learn More at No on Prop 15. View complete list of Coalition Members.